Perplexity AI predicts Nvidia stock price amid SMCI turmoil

As Nvidia (NASDAQ: NVDA) navigates the turbulence caused by Super Micro Computer Inc. (NASDAQ: SMCI)’s recent crisis, Perplexity AI has weighed in with predictions on the chipmaker’s stock price. The AI platform analyzed current market conditions, offering both bullish and bearish scenarios for Nvidia’s future amid the unfolding SMCI turmoil.

The turmoil began when Super Micro’s auditor, Ernst & Young, resigned due to concerns over the company’s financial practices. This news sent shockwaves through the market, causing SMCI’s stock to plummet by over 29%, trading near $34.68. Nvidia, a major supplier to Super Micro, felt the impact as its stock dropped 4% to $136.

Meanwhile, Mizuho analyst Jordan Klein warned of potential repercussions for Nvidia. He cautioned that “if Super Micro’s issues escalate and hinder their ability to fund operations, Nvidia might miss its own forecasts.” Klein suggested that Nvidia is likely to shift most of its GPU supply away from Super Micro until the situation clarifies, potentially benefiting competitors like Dell.

Picks for you

Nate Anderson, founder of Hindenburg Research, hinted at deeper issues, stating:

“The next question may be: What does Nvidia do about a client whose auditor suggests they lack ‘a commitment to integrity and ethical values?'”

– Nate Anderson, Hindenburg Research

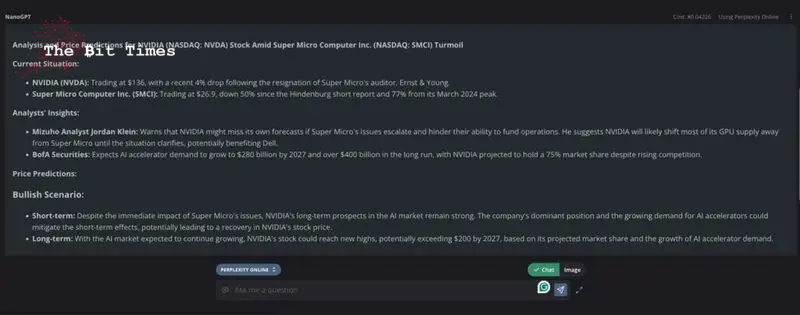

Perplexity AI’s Nvidia stock price predictions

Perplexity AI analyzed the situation, providing insights into Nvidia’s potential stock movements. In the bullish scenario, despite the immediate impact of Super Micro’s issues, Nvidia’s long-term prospects remain strong. The company’s dominant position in the AI market and the growing demand for AI accelerators could mitigate short-term effects.

According to BofA Securities, “AI accelerator demand is expected to grow to $280 billion by 2027 and over $400 billion in the long run, with Nvidia projected to hold a 75% market share.” This optimistic outlook suggests Nvidia’s stock could reach new highs, potentially exceeding $200 by 2027.

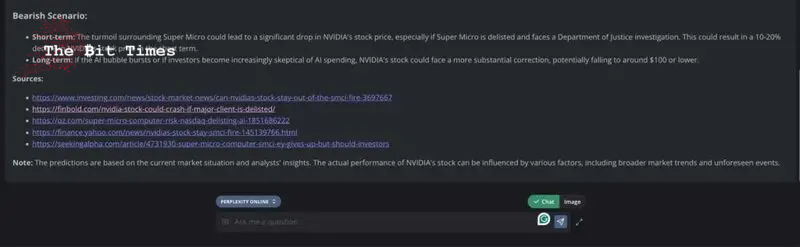

Conversely, the bearish scenario raises concerns about significant short-term declines. If Super Micro faces delisting or a Department of Justice investigation, Nvidia could see a 10-20% drop in its stock price. Additionally, if the AI bubble bursts or if investors grow skeptical of AI spending, the stock could face a more substantial correction, potentially falling to around $100 or lower.

Insider trading and suspicious activities

As things developed, Finbold reported a suspicious trade that rewarded an SMCI short-seller with 3,000% gains and another insider trading-related activity.

While Nvidia grapples with the fallout from Super Micro’s crisis, the future of its stock remains uncertain. The company’s reliance on significant clients like SMCI highlights potential risks. However, its strong position in the burgeoning AI market could propel it forward despite short-term setbacks.

Furthermore, the predictions by Perplexity AI underscore the volatility in the tech sector.

Perplexity was listed among OpenAI’s most feared competitors given its ability to scan the web in real time. On Finbold, we previously used the AI for an Nvidia price prediction based on analysts’ insights.

Investors will be watching closely to see how Nvidia adapts to these challenges. As the situation unfolds, the company’s strategies in navigating this turmoil will be crucial for its stock performance.

Comments

Post a Comment