If you invested $1,000 in Bitcoin when Trump won the election, you’d now have this much

The election of Donald Trump to the office of President will go down in history as one of the most pivotal events of the year. Although pollsters were projecting a tight race, in the end, the GOP candidate secured victory over incumbent Vice President Kamala Harris in each swing state.

Some of Trump’s proposed economic policies — in particular, his preference for tariffs, have caused widespread worry among market participants. They’re far from a done deal — Trump’s first term did include a bevy of promises that were ultimately not kept.

However, the markets have certainly been fairly bullish regarding one thing — and that’s the President-elect’s stance on cryptocurrency.

Picks for you

Beyond his own dealings in the space, through World Liberty Financial, which recently got a $30 million investment from Tron (TRX) founder Justin Sun, Trump has publicly supported crypto, intends to name a wide bevy of pro-crypto experts to hold public office, and intends to establish a strategic crypto reserve for the United States.

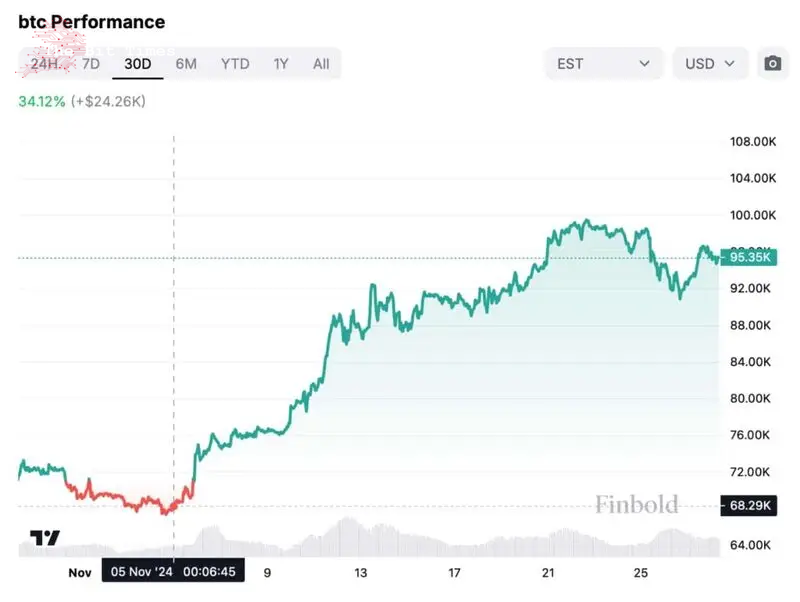

Unsurprisingly, all of this has contributed significantly to the current bull run that the leading digital asset Bitcoin (BTC) is in. To clearly demonstrate how significant this upswing has been, let’s take a look at a simple hypothetical situation — how much money an investor would have if they had invested $1,000 in Bitcoin on November 5, the day of the election.

Bitcoin prices have soared since the 2024 election

On November 5, one BTC was priced at roughly $68,290 — having receded to that point from a prior $72,780 high on October 30. Unlike most recent presidential elections, this one was called rather quickly — Vice President Harris conceded just a day later, on November 6.

At press time, one Bitcoin is trading at approximately $95,530 — a mark which represents a 40.22% increase compared to November 5 prices. Accordingly, a $1,000 investment made on November 5 would be worth $1,398 at the time of publication. This offers an interesting backdrop to reflect on entry points.

For comparison’s sake, if you invested in BTC exactly six months ago, you would have made a negligibly better return of over 40% — or $1,404. If, however, you had bought $1,000 worth of Bitcoin on January 1, your gains would currently stand at 125% — in other words, $2,252.

While some entry points are obviously superior to others, for now, BTC seems to be acting in accordance with one of the most widely-held maxims governing traditional financial assets — time in the market outperforms timing the market, and is much easier to accomplish. Although Bitcoin has hit a roadblock on its path to $100,000, dollar-cost-averaging purchases are still likely to outperform attempts to buy a potential upcoming dip.

Featured image via Shutterstock

Comments

Post a Comment