US Dollar Tanks, Gold Rallies: AI Predicts Which Asset To Invest In?

The US dollar is currently under strict scrutiny, with new foes in the queue to hammer USD down a notch. At press time, the dollar index is sitting at 100, up 0.03% in the last 24 hours. However, the currency has battered down intensely, hitting a new 18-month low in the current situation. At the same time, the Euro has gained 0.6% against the US dollar, with gold surging to touch new value rallies. As investor sentiment embraces the new transformative changes in the field of finance, AI predicts which asset to invest in the long run.

Also Read: Digital Currency: Hong Kong’s CBDC Pilot Testing Enters Phase 2

The Gold vs. Dollar Debate

The US dollar is sitting at its lowest level in 18 months. The DXY index is sitting at 100, while the alternate asset gold has sparked a new price rally of $2,670. The stark correlation has sparked speculation on social media, prompting investors to think of alternate scenarios.

“JUST IN: U.S. Dollar Index, $DXY, hits lowest level in 18 months just as Gold breaks all-time record $2,670. Probably nothing… ”

The US dollar is down considerably as traders continue to bet on November fed rate dynamics. At the same time, the Euro has gained an upper hand in the currency market as China mulls over injecting stimulus to bolster its economy and stocks.

At the same time, Gold has broken a new record in the process by surging to an all-time high of $2,670.

According to financial analyst Rashad Hajiyev, dollar index futures have also noted a decline in their pattern, which may accelerate soon.

Hajiyev later shared his forecast on gold, adding how the precious yellow metal is already on the verge of a breakout. The metal is inching to hit $2,700 in a new rally and may ultimately push forward to hit $3000 by the end of this year.

“Gold had a nice run yesterday, moderately supported by miners. I would expect a small pause around present levels and then another push higher to $2,700.”

Also Read: Can Bitcoin (BTC) Surge To A High of $80K In ‘Uptober’ Rally?

AI Predicts the Next Best Asset

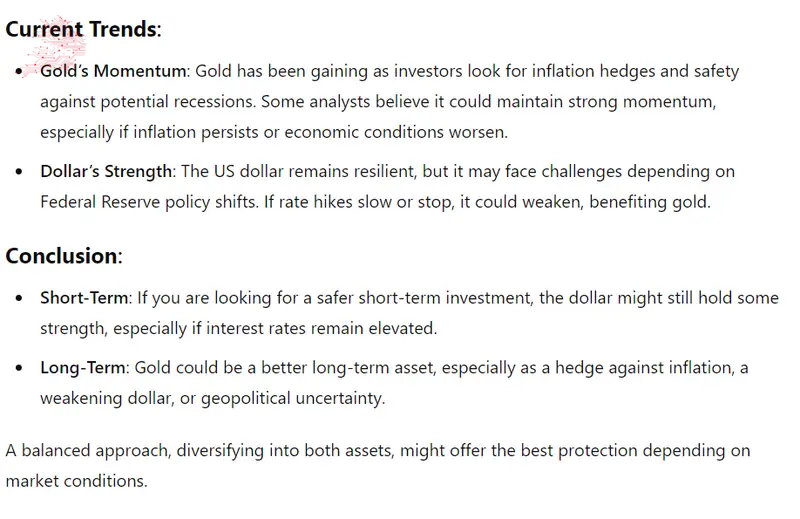

ChatGPT has now joined in the debate, weighing critical scenarios related to which asset at the moment would be best for investment purposes. The AI shared how Gold has considerably risen against all odds in recent times. Despite usual bumps and fallbacks, the asset has noted a spike in its price driven by hoarding of AUX by central banks around the world.

With the US dollar decline, gold being dubbed as an effective inflation hedge is also pushing its price to breach normal price barriers.

Speaking more on dollar strength, GPT shares how the USD remains resilient to such changes but is extremely volatile to federal reserve stances and changes.

Based on the aforementioned Analysis, the AI concluded that the US dollar may prove lucrative for short-term investment. At the same time, ChatGPT claimed gold as the next best asset for long-term investment after weighing in factors like inflation and geopolitical mayhem.

Also Read: Ripple (XRP) & DogWifHat (WIF) Price Prediction For October 2024

Comments

Post a Comment