Bitcoin Whales Bet Big Amid Japan's ETF Approval Buzz

Bitcoin (BTC) markets are seeing significant activity as Japan considers approving Bitcoin ETFs following successful launches in other big economies.

Despite recent price swings, large holders known as whales are buying more BTC, showing faith in the cryptocurrency’s future. This trend aligns with growing interest in Bitcoin ETFs and shifting market patterns.

Also Read: Bitcoin: BlackRock Says ETFs Will Reach $4T by 2030

Japan’s Bitcoin ETF Approval Ignites Whale Buying Frenzy

SBI Holdings and Franklin Templeton Partnership

SBI Holdings and Franklin Templeton are joining forces to:

- Create a cryptocurrency management company

- Launch a Bitcoin ETF once regulators approve

- Leverage Franklin Templeton’s know-how from U.S. Bitcoin and Ethereum ETFs

This team-up could reshape Japan’s crypto landscape, bringing it in line with global trends.

Whale Accumulation Amid Price Volatility

Recent price changes have not deterred large Bitcoin holders. On-chain data reveals significant whale purchases, with many coins moving to long-term holder addresses. This behavior contrasts with smaller investors who might sell during market dips.

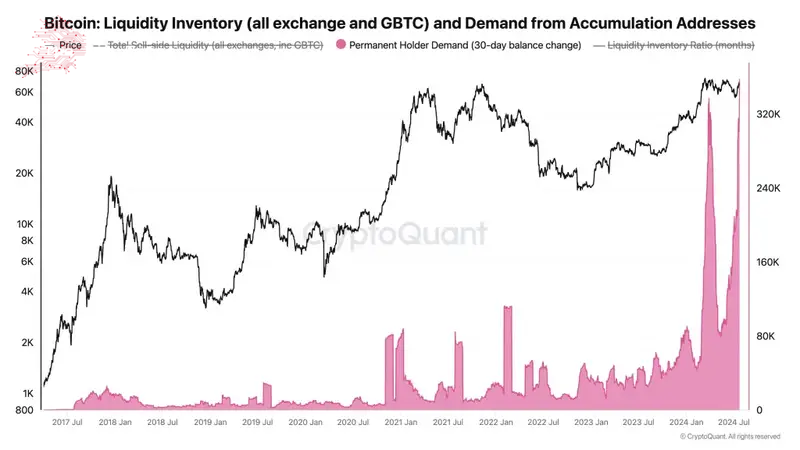

The image shows the rising demand brought by long-term holders. This also bolsters the idea of the confidence of crypto whales.

ETF Inflows and Market Dynamics

U.S. Bitcoin ETFs continue to attract funds:

- BlackRock’s IBIT had $70.7 million in inflows.

- Grayscale’s GBTC saw nearly $40 million in outflows.

- ETF activity continues to be a major market trend.

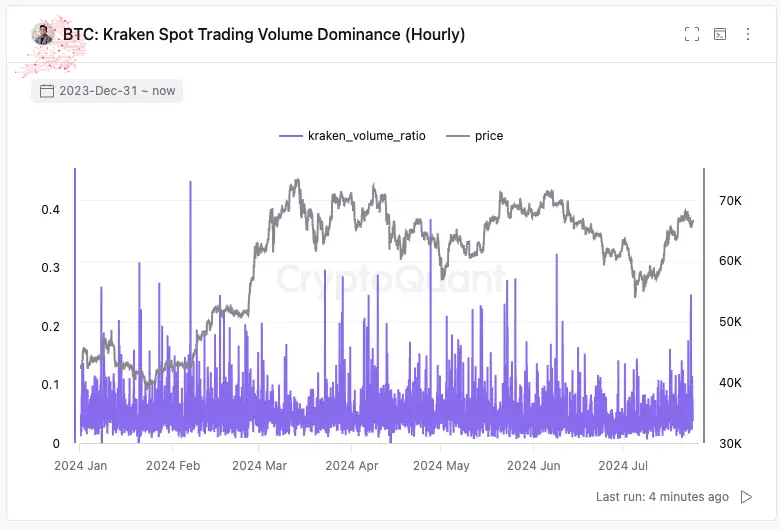

The chart illustrates recent price movements and trading volumes, reflecting market responses to ETF activities.

Also Read: Bitcoin and Ethereum: August Price Predictions Analysis

Mt. Gox Distribution and Market Resilience

The crypto market has shown strength in handling the Mt. Gox creditor repayments:

- Initial fears of a market crash were unfounded

- Trading volumes remained stable, particularly on Kraken

- This resilience points to a more mature market

The graph shows the trading volumes on Kraken. This data indicates the market can handle large-scale distributions.

japan-after-etf-approval">Effects on Japan After ETF Approval

If Japan goes through with its BTC ETF approval, there are some direct possible results:

- Alignment with global crypto financial products

- A boost to Japan’s financial ecosystem

- Increased investor interest and market integration

These changes might solidify Japan’s position in the global crypto arena.

Also Read: Shiba Inu and Bitcoin Price Prediction For August 2024

As Japan approaches Bitcoin ETF approval, whale activity hints at growing trust in BTC’s future. Despite short-term ups and downs, the crypto market shows resilience. Institutional interest, new rules, and big-holder behavior keep shaping Bitcoin’s role in global finance.

Comments

Post a Comment