2 cryptocurrencies to watch closely next week

The cryptocurrency market faces bearish pressure, led by Bitcoin (BTC), struggling to maintain its position above the $60,000 mark. This market movement is widely interpreted as part of Bitcoin’s historical post-halving retracement pattern, wherein the sector experiences a dip before rallying.

Despite the overall market’s somber outlook, Finbold has identified two cryptocurrencies worthy of attention in the upcoming week. Due to underlying fundamentals, these assets may see shifts in their trajectory.

Ethena (ENA)

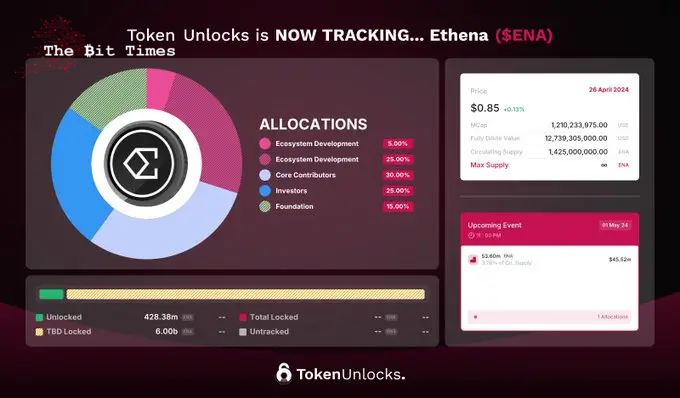

Ethena (ENA), a synthetic dollar protocol, has garnered significant attention in the crypto market since its inception, having been backed by prominent industry figures like BitMEX founder Arthur Hayes. The focus in the coming week is on ENA, with the potential for volatility due to planned token unlocks.

Picks for you

Specifically, Ethena will unlock 53.60 ENA tokens with a valuation of around $46 million, representing 3.76% of the circulating supply. It will be intriguing to observe how the token reacts, particularly amidst speculation about its potential resemblance to troubled projects like Terra.

A recent report from CryptoQuant compounds this concern, warning USDe holders that Ethena’s keep rate (the portion of revenue allocated to its reserve fund) needs to stay above 32% in a bear market to mitigate risks.

This anticipated volatility adds to ENA’s recent gains following the launch of the USDe stablecoin. With an impressive 67% Annual Percentage Yield (APY), the product thrust Ethena into the limelight, attracting investors seeking high returns. This surge in interest led to increased buying pressure, propelling the token’s market capitalization past the $1 billion mark.

As of press time, ENA is trading at $0.81, experiencing daily losses of over 4%. Despite generally tracking the overall market, it has plummeted by nearly 17% over the past week.

Tron (TRX)

In the short term, Tron (TRX) is one of the cryptocurrencies experiencing modest gains in the green zone. This coincides with the Tron blockchain’s positive growth across various metrics in the first three months of 2024.

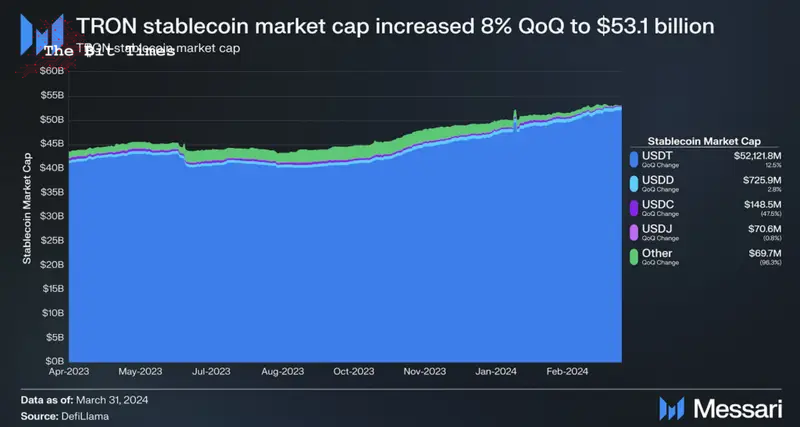

For example, the circulation of USD Tether (USDT) on Tron surpassed $50 billion in Q1. This milestone holds significance for market participants as the flow of stablecoins typically serves as a gateway for fiat onramps, with the potential to influence the price in the long term.

Notably, an upward trend in stablecoin flow suggests increasing demand for assets and a surge in capital inflow from fiat to crypto via stablecoin channels. Additionally, Tron is currently leading in active stablecoin addresses, further underlining its prominence in this segment.

At the same time, during the first quarter of 2024, the market capitalization witnessed a notable surge of 15%, while TRON’s revenue in USD saw a 7% rise, and the total value locked in decentralized finance (DeFi) on the platform increased by 25%.

Nevertheless, whether TRX can sustain this momentum from its strong Q1 performance or if broader market sentiments will influence it remains uncertain.

By press time, TRX was trading at $0.1199 with daily gains of about 1.5%. On the weekly chart, TRX is up almost 10%.

Given the prevailing conditions of the crypto market, it’s important to note that the mentioned fundamentals may not necessarily dictate the fate of the highlighted cryptocurrencies, as they could be susceptible to broader market sentiments.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

Comments

Post a Comment