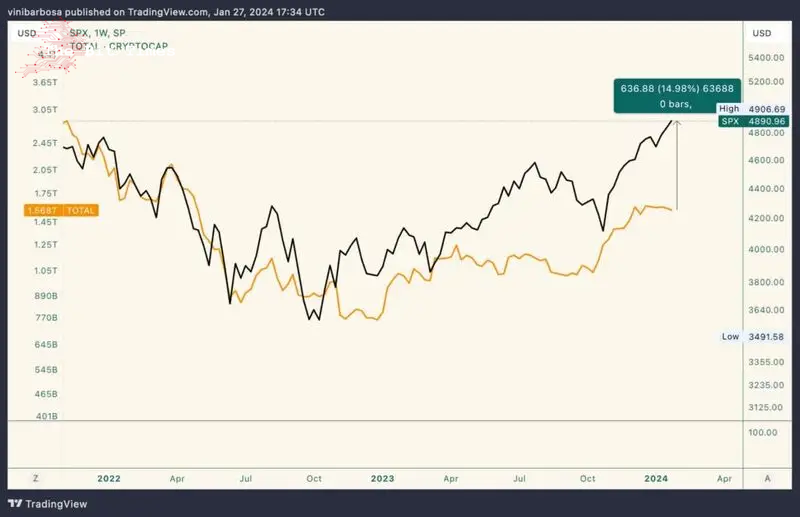

S&P 500 outperformed the crypto market by this much since 2021

Cryptocurrencies first surged as an alternative to traditional finance (TradFi), which includes fiat currencies, banking, and the stock market. However, the cryptocurrency market has become more similar to TradFi over the years, directly competing for investors’ attention.

In 2021, both the crypto and stock markets peaked at the end of a massive bull market. Since then, the latter has outperformed the total crypto market cap index – a sum of all cryptocurrencies’ capitalization.

In particular, the S&P 500 kept nearly 15% more value than the cryptocurrency market. Moreover, the leading stock market index in the world just reached new all-time highs, while crypto is still halfway to its top.

The S&P 500 is currently valued at $4,890, while the other has a $1.568 trillion capitalization. Notably, the total crypto market cap peaked at $3 trillion in 2021.

Markets’ historical battle: Crypto vs. Stock

Interestingly, zooming the chart out will show a similar result. The stock market, illustrated by the S&P 500, outperformed crypto by nearly 10% since 2014.

It is notable that cryptocurrencies distanced themselves from stocks between 2017 to 2020. This happened amid the launch of multiple projects aiming to solve different demands, but the movement slightly lost strength.

As of writing, institutional players from traditional finance are showing a growing interest in crypto and tokenization. Venture capitalists have deployed money into crypto startups, distancing the space from decentralization and non-profit ideals to an ecosystem that resembles TradFi.

In this context, the stock market seems to thrive under these more equal competitive conditions. Nevertheless, crypto’s volatility might play in its favor if a solid bull run forms in the following months.

Investors can now decide on decentralized finance (DeFi) or TradFi, although caution is necessary when navigating such an unpredictable and fast-changing environment.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

Comments

Post a Comment